When it comes to stationery duty-free shops in Osaka, it's handsome!

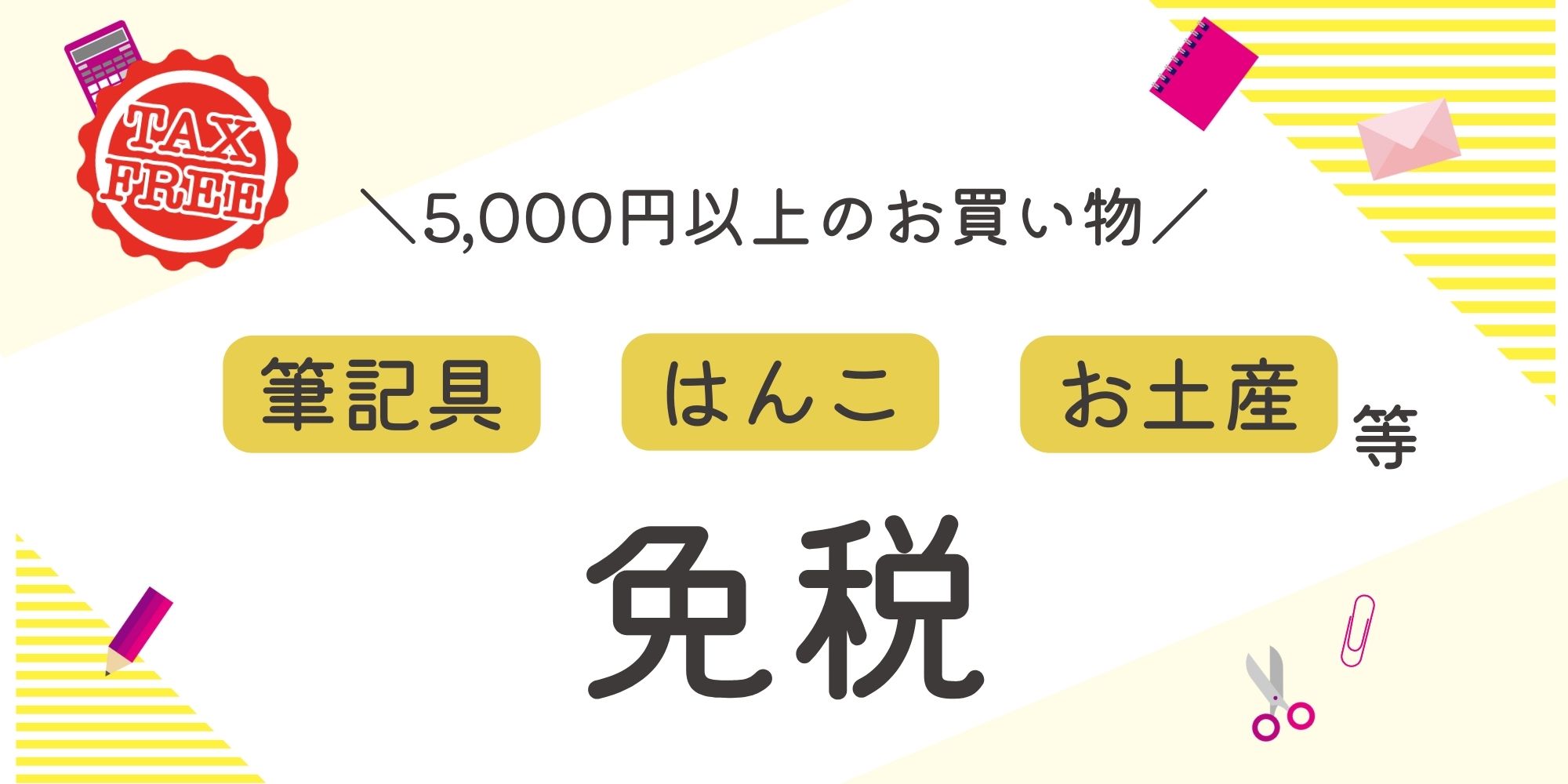

Stationery items in stores are eligible for tax exemption!

Ikeman sells high-quality writing instruments, stamp supplies such as Shachihata, notebooks, and even ballpoint pens. Various products are eligible for tax exemption.

Please enjoy shopping for handsome men.

*Some products are eligible for tax exemption. Please ask the store staff for details.

How can handsome men use tax exemption?

① The clerk will read your passport/entry permit sticker.

②Please pay the bill.

③Please read the QR code from the electronic receipt.

④I will hand over the product to you.

Thank you!! Enjoy your trip!

What is tax exemption?

A system that allows people who do not live in Japan to exempt themselves from consumption tax

When purchasing specific items such as souvenirs for foreign travelers or non-residents, if certain conditions are met, This is a system that allows products to be sold exempt from consumption tax.

Ikeman is a stationery store that has obtained permission to be a "duty-free store"!

Actually, not everyone can shop duty free. Ikeman is a shop that can sell tax-free goods with the permission of the tax director♪

Initiatives for customers traveling overseas

At Ikeman, we are working hard to make shopping enjoyable for our overseas customers!

Various payment systems

Ikeman offers payment methods that are easy for overseas customers to use, such as various VISA and UnionPay.

Wifi compatible

Ikeman is fully equipped with Wift! If you need a network, please contact our staff.

Tax exemption rules and precautions

Please note the following points when purchasing products tax-free.

- It can be confirmed that the applicant has entered Japan less than 6 months ago (excluding diplomatic, official, and U.S. military).

- If you are a non-resident and have Japanese nationality, it can be confirmed that you have entered Japan for less than 6 months.

- If you do not have your passport, you cannot receive tax exemption.

- If you do not have an entry stamp, such as when entering the country through an automatic gate, you will not be able to sell tax-free as there is no proof of entry.

- Items sold on the day are eligible for tax exemption.

- There are some items that cannot be brought into the country.

- When leaving the country, please present the item with the purchase record label attached to the customs office at the airport or port.

- You cannot open the purchased bag until you return to your country.